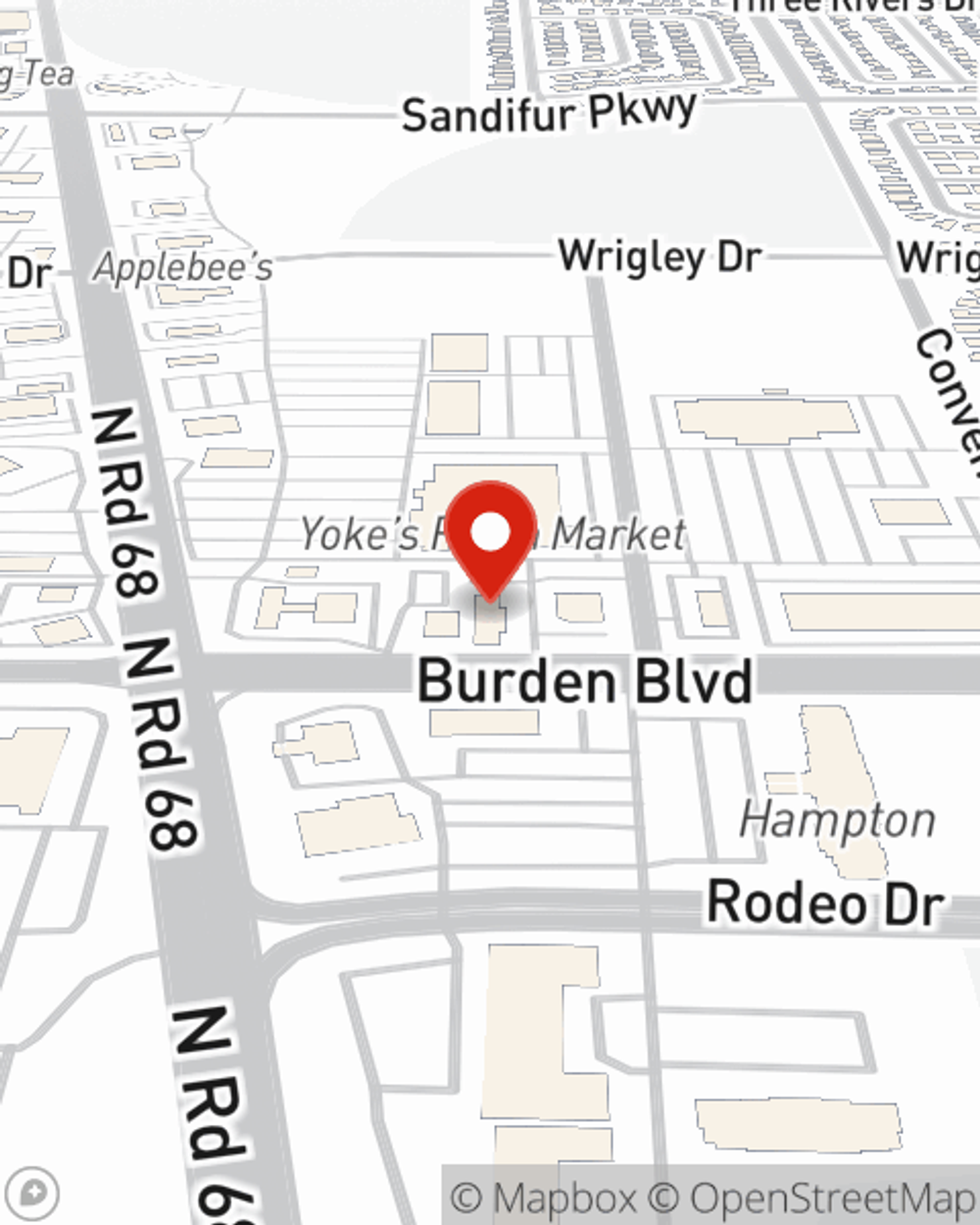

Business Insurance in and around Pasco

Pasco! Look no further for small business insurance.

Helping insure small businesses since 1935

This Coverage Is Worth It.

Do you own a real estate appraisal business, a book store or an insurance agency? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on your next steps.

Pasco! Look no further for small business insurance.

Helping insure small businesses since 1935

Insurance Designed For Small Business

You are dedicated to your small business like State Farm is dedicated to fantastic insurance. That's why it only makes sense to check out their coverage offerings for commercial liability umbrella policies, builders risk insurance or surety and fidelity bonds.

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Jason Cowgill's office today to learn about your options and get started!

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Jason Cowgill

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.